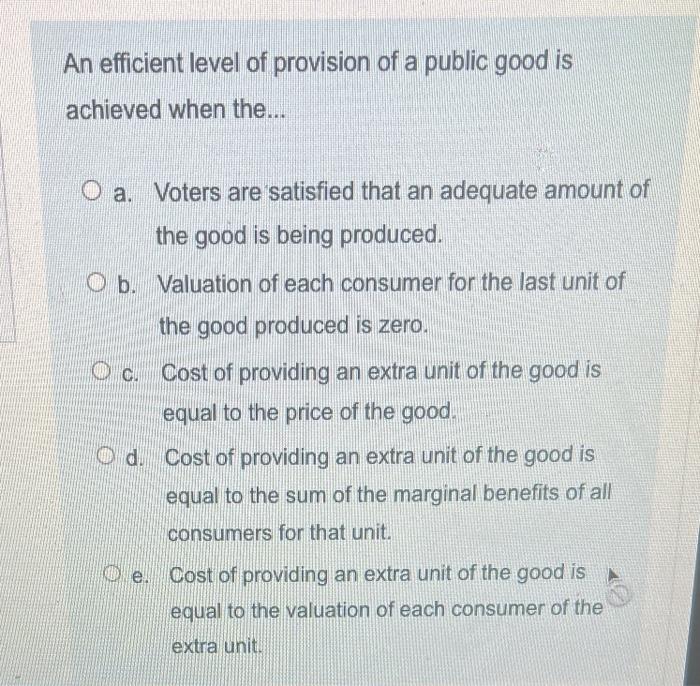

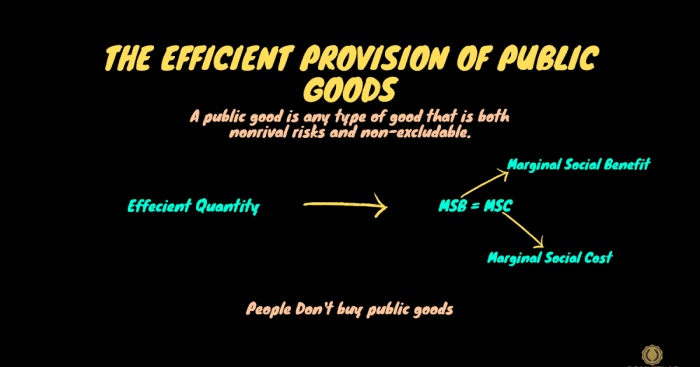

The provision of a public good generates a positive externality, meaning that it benefits society as a whole rather than just the individuals who directly consume it. This is in contrast to a private good, which only benefits the individual who consumes it.

Public goods are often provided by the government because the private market fails to provide them efficiently. This is because the benefits of public goods are often difficult to exclude, meaning that people cannot be prevented from enjoying the benefits even if they do not pay for them.

As a result, the private market has no incentive to provide public goods.

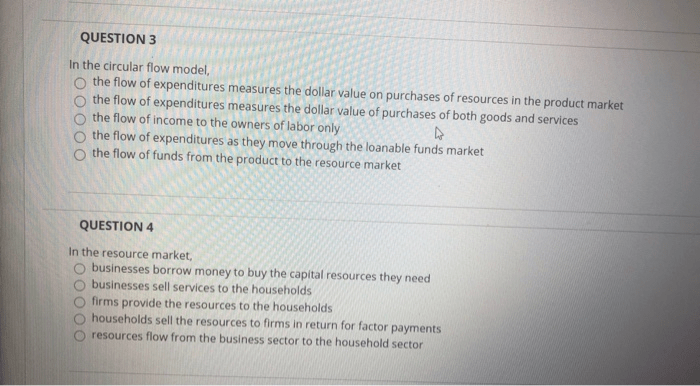

1. Economic Theory

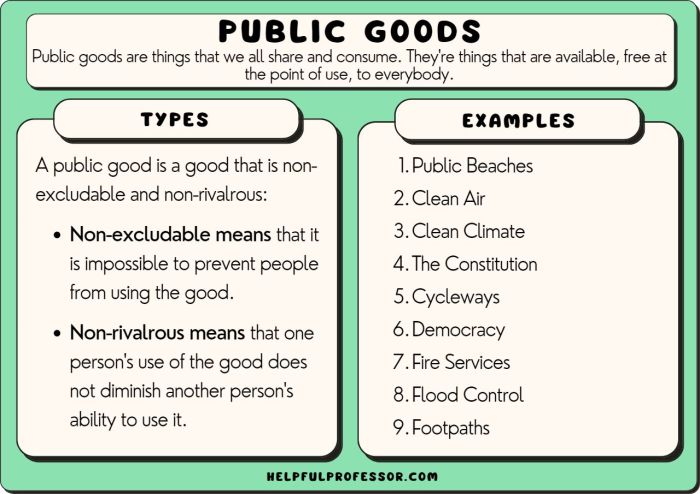

Public goods are non-excludable and non-rivalrous, meaning that they can be enjoyed by all individuals in society, regardless of whether they pay for them or not. This makes it difficult for private firms to provide public goods, as they cannot charge a price that will cover their costs.

Public goods are essential for a well-functioning society. They provide the foundation for economic growth and social progress. However, the provision of public goods can be challenging, as it often requires government intervention.

Characteristics of a Public Good

- Non-excludable: It is impossible or very costly to exclude individuals from consuming the good.

- Non-rivalrous: One person’s consumption of the good does not reduce the amount available for others.

- Externalities: The consumption of the good by one person generates positive or negative externalities for others.

Examples of Public Goods

- National defense

- Law enforcement

- Public parks

- Public libraries

- Public health

2. Provision of Public Goods

The provision of public goods can be achieved through various mechanisms:

Government Provision

Governments play a crucial role in providing public goods due to market failures. They can fund and manage the production and distribution of public goods through taxation or public borrowing.

Private Provision

In certain cases, private entities may provide public goods if they can generate revenue through alternative sources, such as advertising or membership fees. However, this approach is often limited to quasi-public goods that exhibit some degree of excludability or rivalry.

Non-Profit Provision

Non-profit organizations can also contribute to the provision of public goods by relying on donations, grants, or membership fees. They often focus on specific social or environmental causes.

Challenges in Providing Public Goods

- Free-riding: Individuals may benefit from public goods without contributing to their provision.

- Externalities: The provision of public goods can generate both positive and negative externalities, making it difficult to determine the optimal level of provision.

- Political influence: Government provision of public goods can be influenced by political interests, leading to inefficient or inequitable outcomes.

3. Benefits of Public Goods

Public goods offer numerous benefits to society:

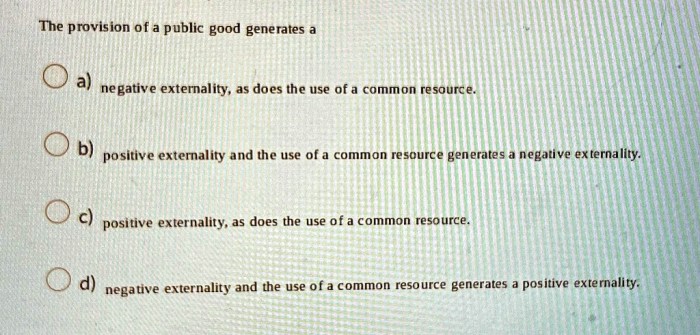

Economic Growth, The provision of a public good generates a

- Infrastructure: Public goods such as transportation networks, energy systems, and communication technologies facilitate economic activity and trade.

- Education: Publicly funded education enhances human capital, leading to increased productivity and innovation.

- Research and development: Public investment in research and development fosters technological advancements and economic growth.

Social Benefits

- Health: Public health measures, such as immunization and sanitation, improve the well-being of the population.

- Safety: Public safety services, including law enforcement and fire protection, create a secure environment for individuals and businesses.

- Social equity: Public goods, such as public assistance and education, can promote social equality and reduce income disparities.

4. Costs of Public Goods

The provision of public goods entails various costs:

Financial Costs

- Taxation: Governments primarily rely on taxation to finance public goods, which can impose a burden on taxpayers.

- Public borrowing: Governments may also borrow to fund public goods, leading to increased public debt and potential interest payments.

Opportunity Cost

The provision of public goods often requires the allocation of resources away from other potential uses. This can result in trade-offs, where the benefits of providing a public good must be weighed against the costs of foregoing alternative uses of those resources.

5. Financing Public Goods

Various mechanisms are used to finance public goods:

Taxation

Taxation is the primary method of financing public goods. Governments impose taxes on individuals, businesses, and property to generate revenue for public spending.

User Fees

In some cases, public goods can be partially financed through user fees. These fees are charged to individuals who directly benefit from the good, such as tolls for roads or admission fees for parks.

Grants and Donations

Governments and non-profit organizations may receive grants and donations from private individuals, foundations, or international organizations to support the provision of public goods.

6. Case Studies: The Provision Of A Public Good Generates A

Successful Provision of Public Goods

- Public education: Many countries have successfully implemented public education systems that have contributed to economic growth and social mobility.

- Public healthcare: Universal healthcare systems, such as those in the United Kingdom and Canada, have improved health outcomes and reduced healthcare disparities.

- Public transportation: Efficient public transportation systems, like those in Japan and Singapore, have reduced traffic congestion and improved air quality.

Challenges in Providing Public Goods

- Water scarcity: Many developing countries face challenges in providing access to clean water due to infrastructure constraints and population growth.

- Climate change mitigation: The provision of public goods related to climate change mitigation, such as renewable energy and carbon capture, faces challenges due to high costs and technological limitations.

- Political instability: In some countries, political instability and corruption can hinder the effective provision of public goods.

Essential Questionnaire

What is a public good?

A public good is a good that is non-rivalrous and non-excludable. This means that it is impossible to prevent people from enjoying the benefits of a public good, even if they do not pay for it.

What are some examples of public goods?

Some examples of public goods include clean air, national defense, and public parks.

Why does the government provide public goods?

The government provides public goods because the private market fails to provide them efficiently. This is because the benefits of public goods are often difficult to exclude, meaning that people cannot be prevented from enjoying the benefits even if they do not pay for them.